REX Royalty Exchange

REX Royalty Exchange

A royalty contract requires the company to pay a percentage of its revenues to the royalty holder, for an agreed period of time.

For example, a company may agree to pay an investor 5% of its gross revenues to an investor for 20 years, in exchange for the capital the company needs to build its business.

In the early stages, some companies anticipate very fast growth; this is often the case with technology companies. These companies may be concerned about paying a percentage of the expanding revenues they project, because the payments could become very large when the company is successful. The sale of royalties reduces an issuer’s profit margin. A smaller profit margin will adversely impact the market valuation of the issuer if the company is publicly traded and/or is negotiating a merger or sale of the company.

Therefore, a method to limit the amount of royalty payments may be desirable to the issuer of the royalty, if the company is highly successful. The owners of a company considering the sale of royalties may wish to have a method for the termination of royalty payments at a future date. There are several methods of doing this; which will serve the interests of both the company and the owners of its royalties.

The most basic method is for the company to include in the royalty agreement a redemption feature which allows the issuer to pay to all of the royalty owners an agreed amount, within an agreed period, to terminate the royalty. It is important, from the issuer’s perspective, that the terms of redemption be negotiated and be in the original agreement, as otherwise the issuer may not be able to acquire and therefore terminate the royalty payment obligation on terms which are acceptable.

If the royalties were traded on a public securities exchange, as proposed in the China Royalty Exchange project, there may be many royalty contract owners; the company could simply make an offer on the exchange. With a large marketplace of public investors, the redemption process would be more liquid and efficient. The company’s future earnings would increase by the amount of pre-tax royalty payments no longer required to be paid, and the company’s market valuation would be increased by an amount reflecting the company’s price/earnings ratio.

A better approach for all parties may be in the “REX Defined Value-Time Period Royalties” (DVTP). With this approach, the original royalty agreement provides that if a certain amount of royalty payments are paid within a certain period of time, the royalty will be automatically redeemed and further payment obligations will be cancelled. This approach provides certainty and security to both the company and its investors.

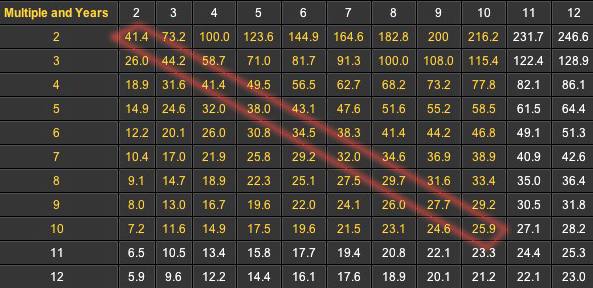

A redemption table would be agreed: if a minimum of X times the original investment is paid (as a percentage of revenues or otherwise), to royalty investors in Y years, then redemption is automatically triggered.

Below is a table which defines this method, and includes the corresponding Internal Rate of Return for each case.

2 times within 2 years – a 41.4% annual return

3 times within 3 years – a 44.2% annual return

4 times within 4 years – a 41.4% annual return

5 times within 5 years – a 38% annual return

6 times within 6 years – a 34.5% annual return

7 times within 7 years – a 32% annual return

8 times within 8 years – a 30% annual return

9 times within 9 years – a 27.7% annual return

10 times within 10 years – a 25.9% annual return

This table is on the Royalty Financing Calculator, available worldwide at no cost at http://www.rexroyalties.com

The series described above is highlighted in red below. This tool may be used as an aid in negotiation of terms.

The above Internal Rate of Return (IRR) chart is used as a standard by the American venture capital industry to estimate possible rates of return based on an assumed sale price. It is normally employed when considering the purchase of securities. The chart provides an approximation. In order to precisely determine an actual IRR, the exact timing and amount of payments needs to be known. To calculate a comparable IRR for the owner of a royalty contract, assuming a redemption by the issuer or a sale by the royalty owner, an amount equal to the purchase price of the royalty would need to be included in the calculation.

The DVTP royalty issuer does not need to make offers or conduct negotiations in order to redeem its royalties. Redemption takes place automatically when the necessary amount has been paid to its royalty investors. And since the required payments are cumulatively calculated and do not need to come from only a percentage of revenues, the company can choose its own time to redeem, by adding the required amount of total payment to the royalty payments made to date.

In the case of a successful, fast growing company, the owners, having avoided equity dilution, would be enriched and the results would be very favorable and fair for the royalty owners. Royalty owners in companies having revenues begin receiving income immediately, if the revenues grow constantly the royalty owners make a very good return, as the royalty payments increase as the royalty issuer’s revenues increase.

Arthur Lipper, Chairman

British Far East Holdings Ltd.

March 11, 2013

with the assistance of Michael North

English

English  简体中文

简体中文