Valuing Royalties

Suggested Valuation Methodologies

for Royalty Contracts

The valuation of a royalty or contractual right to receive an agreed percentage of a company’s revenue is an art, and not a science.

1. The primary concern of the royalty investor is the certainty of receiving, in a reasonable period of time, at least the amount paid for the royalty.

1. The primary concern of the royalty investor is the certainty of receiving, in a reasonable period of time, at least the amount paid for the royalty.

A company’s ability to pay royalties depends on when the royalties are to be paid. If the royalties are paid at the same time as the royalty issuer receives the revenues on which the payment obligation exists there is little risk of non-payment. However, if the royalty owner becomes an account payable on the royalty issuer’s books, then the claims of other creditors can be an issue, as there are different priorities relating to the amounts due. Therefore the balance sheet of the royalty issuer becomes of primary concern to the royalty holder. Royalties issued by companies which have strong finances will be worth more than those issued by weaker companies.

2. The next concern is if the payments received will yield more than alternative investments having a similar risk, as available at the time of acquisition.

The level of royalty payment (unless there is an agreed minimum amount) which is to be paid periodically or at agreed time in the future, is totally dependent on the level of revenues. Therefore, the investor must assess the projections made by the company issuing the royalty and apply their own prediction of how successful the company will be in marketing its goods and services. If the customers find the company’s offerings to be of benefit, then revenues are likely to increase. If the customer prospects do not find the products and services appealing, then the revenues will disappoint both the owners of the business and the royalty holders counting on increasing revenues to produce increasing royalty payments.

3. The next concern is whether the royalty issuer do as promised at the time of acquisition.

The royalty issuer’s ability to meet its royalty payment obligations is far easier to assess if the royalty payments are made at the time of the company’s receipt of revenue. If the royalty owner has some form of leverage over the royalty issuer, the issuer is more likely to do as agreed in terms of information provision and royalty payments. Absent such leverage, the royalty holder is wholly dependent on the integrity of the issuer and circumstance.

4. The final concern is, will the buyer of the royalty be able to sell the royalty, at a fair price, if he does not wish to hold the royalty until it matures?

Royalties are negotiable financial instruments and can be freely bought and sold (unless they are restricted) as long as a willing seller can find a willing buyer, who has the money available to make a purchase. Therefore, unless there is a free market where those having capital to invest and are interested in the purchase of royalties can be made aware of a royalty owner’s wish to sell, the price a seller receives for a royalty is dependent on a negotiation, perhaps using a broker or other intermediary. However, were there to be a royalty exchange, with government supervision and transparency of dealing, the royalty owner wishing to sell would likely receive a much better offer for the royalty.

All investing is an art and not a science, though royalty investment is easier and requires less knowledge of accounting and a company’s internal matters, since the future value of a royalty will be determined by the royalty payments received and those payments will be determined by how well the company’s prospective customers value the company’s offerings.

In the free website http://www.REXRoyaltyFinancingCalculator.com, users can enter projected revenues, the royalty rate, the number of years of royalty payment, and the website will instantaneously calculate the payments to be received, assuming the revenue projections are achieved.

In using the website to understand the impact of changes which can be made to the inputted data, issuers and investors can negotiate on an even playing field as the results of changing royalty payments in different time periods and of changing the assumptions for revenue growth can be immediately shown.

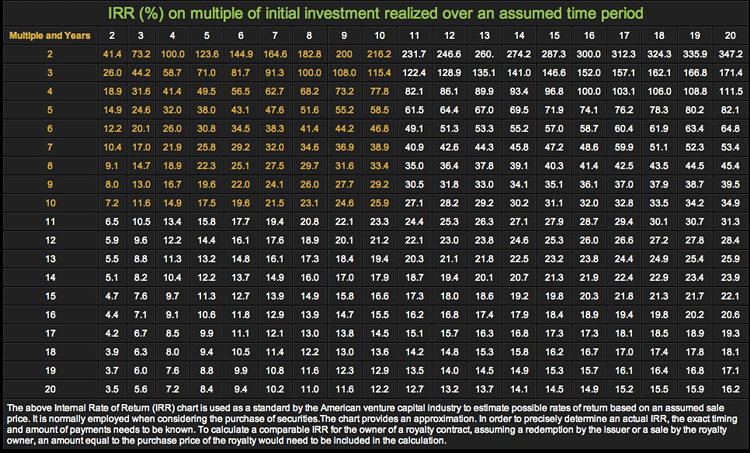

The investor in royalties should have an objective as to minimum yield on the investment made, and the Internal Rate of Return table provided at the http://www.REXRoyaltyFinancingCalculator.com website will show the rates of return based on the amount of royalty payments received.

Investors can buy royalties for secure growing income or for speculatively anticipated high returns and royalty value increases, all depending on their risk tolerance.

Royalties also represent the best way for a business owner to gain the use of capital without surrendering elements of ownership or encumbering his company with debt.

Arthur Lipper

with the assistance of Michael North

January 30, 2013

English

English  简体中文

简体中文